Everything about Eb5 Immigrant Investor Program

Everything about Eb5 Immigrant Investor Program

Blog Article

Some Of Eb5 Immigrant Investor Program

Table of ContentsSome Known Incorrect Statements About Eb5 Immigrant Investor Program Some Known Factual Statements About Eb5 Immigrant Investor Program The Best Guide To Eb5 Immigrant Investor ProgramSome Ideas on Eb5 Immigrant Investor Program You Should KnowSome Known Factual Statements About Eb5 Immigrant Investor Program The 10-Second Trick For Eb5 Immigrant Investor ProgramWhat Does Eb5 Immigrant Investor Program Mean?The Facts About Eb5 Immigrant Investor Program Revealed

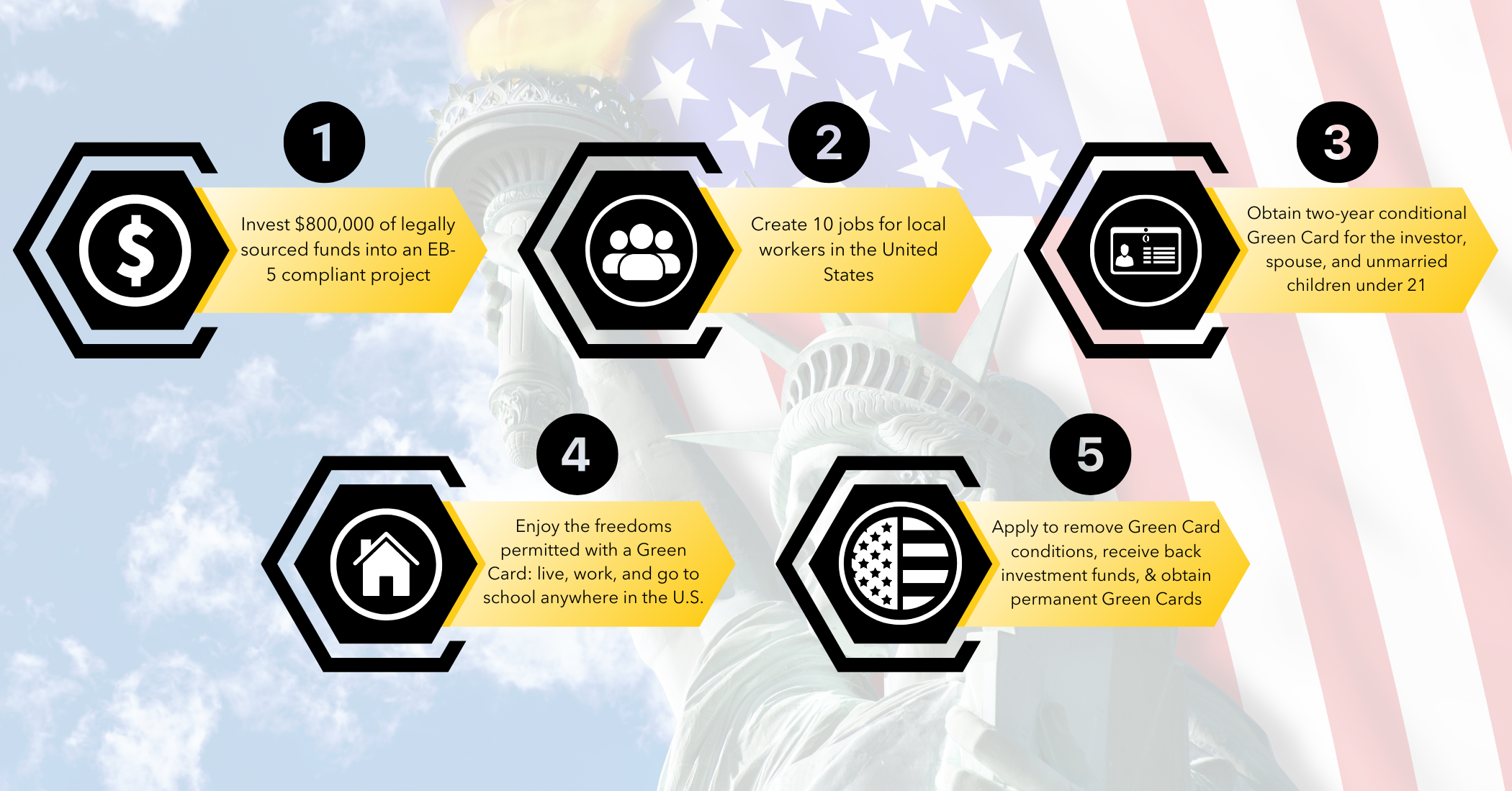

The capitalist must look for conditional residency by sending an I-485 petition. This petition has to be sent within 6 months of the I-526 authorization and have to consist of evidence that the financial investment was made which it has developed at the very least 10 full time jobs for U.S. employees. The USCIS will certainly review the I-485 request and either accept it or request added proof.Within 90 days of the conditional residency expiry date, the investor needs to send an I-829 request to get rid of the conditions on their residency. This petition has to consist of proof that the financial investment was continual which it produced a minimum of 10 permanent work for U.S. employees. If the I-829 request is approved, the capitalist and their family participants will be provided irreversible residency in the USA Get in touch with us for more assistance concerning the application demands.

Not known Facts About Eb5 Immigrant Investor Program

dollar fair-market worth. The minimum amount of funding required for the EB-5 visa program might be reduced from $1,050,000 to $800,000 if the financial investment is made in a business entity that is located in a targeted work location (TEA). To qualify for the TEA classification, the EB-5 project must either be in a backwoods or in a location that has high unemployment.

employees. These tasks should be created within the two year period after the investor has received their conditional long-term residency. In many cases, -the financier has to have the ability to prove that their financial investment caused the creation of straight tasks for staff members that work directly within the industrial entity that got the financial investment.

The Facts About Eb5 Immigrant Investor Program Revealed

Regional centers provide EB-5 projects. It might be a lot more beneficial for an investor to buy a regional center-run task due to the fact that the capitalist will not need to separately establish the EB-5 tasks. Infusion of 8500,000 as opposed to $1,050,000 is not as difficult. Capitalist has even more control over day to day procedures.

Financiers do not require to create 10 jobs, yet keep 10 currently existing positions. Service is currently troubled; thus, the financier might imagine a far better offer. Capitalist has more control over day to day procedures. Mixture of $800,000 instead of $1,050,000 is not as troublesome. Eliminates the 10 staff member requirement, allowing the investor to qualify without directly employing 10 individuals.

Congress provides regional facilities top priority, which can suggest a quicker path to authorization for Type I-526. Financiers do not need to create 10 straight tasks, but his/her investment needs to produce either 10 direct or indirect work.

The financier needs to show the development of 10 work or perhaps even more than 10 work if broadening an existing company. If company folds up within two year duration, financier might shed all invested capital.

More About Eb5 Immigrant Investor Program

Worsened by its area in a TEA, this service is already in distress. Have to generally live in the same place as the enterprise. If service folds within 2 year period, capitalist might shed all spent resources. Investor requires to reveal that his/her investment develops either 10 direct or indirect jobs.

Generally used a setting as a Minimal Responsibility Companion, so capitalist has no control over everyday procedures. Moreover, the basic companions of the local center company typically gain from capitalists' financial investments. Financier has the alternative of buying any type of kind of enterprise top article throughout the united state May not be as risky due to the fact that investment is not made in an area of high unemployment or distress.

Little Known Questions About Eb5 Immigrant Investor Program.

Congress provides regional centers leading priority, which might indicate a quicker path to approval for Form I-526. Financiers do not need to produce 10 direct tasks, yet their investment ought to produce either 10 straight or indirect tasks.

If service folds up within two year period, capitalist could shed all spent funding. The capitalist needs to show the production of 10 jobs or possibly even more than 10 jobs if expanding an existing organization.

The capitalist needs to keep 10 already existing staff members for a period of at the very least 2 years. If an investor likes to invest in a local facility firm, it might be better to invest in one that only needs $800,000 in financial investment.

An Unbiased View of Eb5 Immigrant Investor Program

Investor needs to reveal that his/her financial investment creates either 10 direct or indirect work. The general partners of click resources the local facility company normally benefit from financiers' financial investments.

An Unbiased View of Eb5 Immigrant Investor Program

residency. $5 million (paid to the united state government, not a company). Unlike EB-5, Gold Card capitalists do not need to develop tasks. Trump has marketed this find more as a "copyright-plus" program, recommending possible benefits past common irreversible residency. The program limited to 1 million Gold Cards internationally. Similar to EB-5, it could eventually bring about U.S.employees within 2 years of the immigrant financier's admission to the United States as a Conditional copyright. For complete information about the program, please check out. The financial investment need of $1 million is lowered to $500,000 if an investment is made in a Targeted Employment Area (TEA). In urban areas, TEAs need to have a joblessness rate of a minimum of 150% of the national ordinary joblessness rate.

Report this page